Blog 5: Planning for your own death

The concept of preparing for your own eventual death is completely new to me. It’s just not a thought that has ever occurred to me. I have never even seen a scenario like this play out in a movie. The only scenario on screen that comes close is the terminally ill person who has decided to knock things off their bucket list and live life to the fullest. But I am talking about young to middle aged healthy people making arrangements for the inevitable as opposed to leaving the arrangements to the next of kin. How did I get here? My mother passed away in November 2023 and my siblings and I didn’t have a real voice in how she would be buried. In the absence of a will, we have to figure out how to secure her estate, finances, bills, etc. I learned from the experience that I should prepare sooner than later for my own death to make things easier for my family. In this blog, the fifth in the series, I talk about preparations we can and should make now because life is unpredictable. If you haven’t already, please read the first blog for a contextual background before reading this one.

Step 1: Accept death as an inevitable

We often take it for granted that our time to go will be when we are old and grey. This is the ideal, but life is simply unpredictable. That said, a unhealthy obsession about death is a terrible thing. We don’t need to live in fear but accepting that death could come at any point requires some minimal organisation which I will get into. As a single parent, I have had panic moments and the unhealthy fear of something happening to me and not knowing what happens with my kid. It gave me peace of mind to have a conversation with my son so that he knows what to do. My son now has some phone numbers on his ipad and he knows to find an adult that can call these numbers (until such a time when he can have his own phone). He also knows who he would live with if I am not around.

Accepting the reality of our mortality is in a way liberating. Acknowledging that we are on borrowed time helps us to value life in a more profound way.

Step 2: Prepare a will

In the first blog, I explained the circumstances that led me to prepare a will in my 20s. When I had a child in my 30s, the will was promptly updated. A lot of circumstances have also changed that requires me to update my will and also factor in new considerations for example how I want to be buried and who becomes the legal guardian for my child.

Step 3: Have clear documentation on your finances

I know that there are married couples who do not even share what they individually earn or how much they have in their respective savings. It’s always a double tragedy to lose a spouse and then be completely vulnerable due to lack of information about their finances. This is not just a dilemma for married couples. It applies to anyone. In my case, my siblings and I will have to go through a court in order to have access to my mum’s bank account and take ownership of her properties. This requires us to hire a lawyer which is also expensive. We learned that once the court officially agrees to us being her beneficiaries, we will have to pay a tax on her properties before we can fully claim ownership. We only know about one bank account. If my mum had others, we don’t know about them.

What I plan to do is to thoroughly document my accounts and all relevant financial information for the person(s) that will manage my affairs while my son is still a minor. This will include all bank accounts, cards, loans, bills etc. A list of all important legal documents and where to find the original copies will be made. For me, its important that I don’t leave any financial burden even in the short term. Therefore, I will provide complete access to an account for urgent withdrawals/payments to provide for a burial and to ensure that my son and my staff are well taken care of.

Step 4: Consider a funeral plan and life insurance

I mentioned in the first blog that a good friend’s mother passed away in Europe and she had a funeral plan. Prior to this, I had never heard of such a plan, and I don’t know the extent to which these are available in Ghana. Life insurance policies are however available. I do not have one currently but its definitely worth exploring.

Conclusion

I hope these thoughts are useful for you. Thanks for reading and for the opportunity to share my thoughts. For anyone grieving, my thoughts are prayers go out to you.

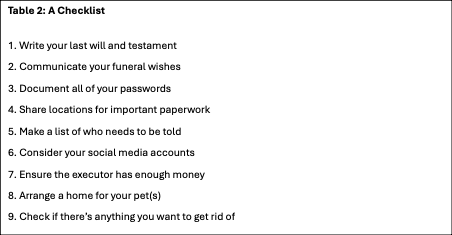

The checklist below may also be useful in making your preparations.

Peace and love

Source: https://untanglegrief.com/end-of-life-planning-checklist/#1_Write_your_last_will_and_testament

Additional resources: